The Rate Lock-In Effect on Home Builders

May 9, 2024

The lack of new residential construction completed in the last 10 years has been a significant strain on supply-side for housing. A near decade of Zero Interest Rate Policy (ZIRP) and strengthening economy re-energized demand. This combination of decreased supply combined with increased demand drove the increase in property value. However, markets across the US are now facing an additional shortfall in supply on the existing home inventory side due to the “Rate Lock-in Effect”.

What is Rate Lock-In?

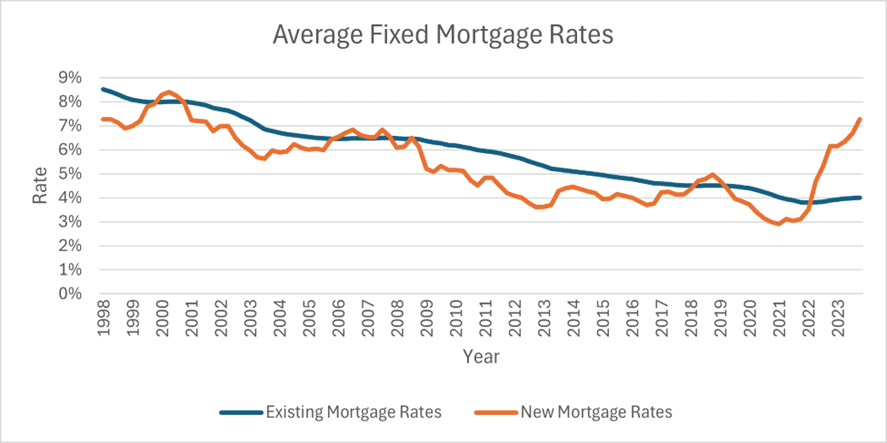

Rate lock-in occurs when the interest rate for a new loan significantly exceeds the interest rate for a similar, existing loan. Decades of low interest rates dragged down the average existing fixed mortgage rate to below 4% in 2022. At the same time, the Federal Reserve raised the federal borrowing rate 11 times within a 15-month period, creating a staggering 3.2% difference between average existing mortgage rates and new mortgage rates as of Q4 2023(1).

Rate Lock-In Effect on the Market

The overall effect of rate lock-in on the market is complicated. On one side, a lack of existing home inventory on the market has a positive impact on home prices. However, a lack of buyers exiting an existing mortgage and purchasing another home stifles demand. Overall, the Federal Housing Finance Agency has predicted a 2.5% increase in home prices in 2022 – 2023 can be attributed to the rate lock-in effect(1).

How Home Builders Can Take Advantage

Despite supply challenges with both existing and new home inventory, a historically low unemployment rate and strong economy has kept demand relatively strong for home ownership. Builders should consider several initiatives aimed at closing the gap and reducing the rate lock-in effect to create more demand. One type of program becoming more popular in today’s market is offering a mortgage rate buydown incentive for buyers. For instance, as of Q4 2023, a 1% decrease in mortgage rates would have a 29% favorable change to the rate lock-in effect(1). Another method to reduce the rate lock-in effect is to offer lease purchase programs. Under this method, the builder leases the property to a buyer for a period, and the buyer has the option to purchase the property at the end of the lease. This gives the buyer more flexibility to avoid locking themselves into a much higher interest rate.

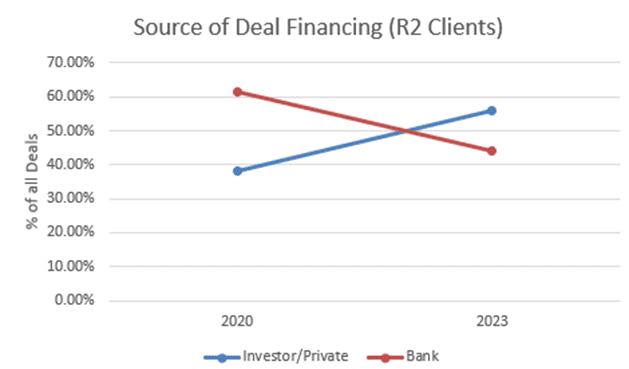

R2 Management is The Builder’s CFO, combining decades of experience in the home building industry with connections to a variety of Investors searching for builders to partner with and deals to invest. We have directly managed over 18,000 Closings and $3.7 Billion in revenue for Builders and Developers. Our team of tenured professionals in the residential construction industry allow scaling or established Builders to rely on much-needed expertise without the tremendous overhead burden.